Cryptocurrency is the talk of the town once again. After the number one digital asset by market capitalization crossed the $10,000 price point for the first time in almost a year and a half, the mainstream media started to look at the cryptocurrency industry with renewed interest.

With prices across the board frequently in the green of late, a lot of optimism has returned to the crypto space. We’ve identified some trends of late, many of which seem to relate to the rising btc price. Here are five and them that we expect to continue, likely inspiring even more people to look at cryptocurrency with a more open mind going forward.

Institutional Interest

Although cryptocurrency prices slumped over 2018, many of the largest players in finance were working to put out their own cryptocurrency products and services during the downtime. Many of these are specifically tailored to a wealthier class of investor that has been traditionally associated with cryptocurrency investments.

Take Fidelity’s interest in the space. The multi-trillion-dollar asset manager has not only been mining crypto for years but it has recently launched an institutional-grade crypto custody solution. Fidelity is a huge name in the money management industry. There is a slim chance that such a company would risk its reputation on something like Bitcoin if there wasn’t demand from its clients already.

Another service from a massive name that signals clear institutional interest is Bakkt. The owners of the New York Stock Exchange are behind the much-anticipated “one-stop-shop” for cryptocurrency. Again, aimed more towards the wealthier investor, Bakkt seeks to bring regulated price discovery to the crypto space. This will surely inspire a lot of confidence in Bitcoin and any other digital assets supported by Bakkt in the future.

Bakkt finally goes into testing this month and there will no doubt be some fireworks with the Bitcoin price around its full-blown launch, hopefully towards the end of this year.

Stablecoins

Stablecoins themselves are hardly new but what is new are the kinds of companies starting to offer them. The likes of JP Morgan with the closed network “JPM Coin” for institutional clients of the bank and Facebook’s recently-detailed Libra are two of the earliest offerings from the absolute giants of the world of business.

As 2019 turns into 2020, we’re expecting more of these massive names to come out with their own plans for not-so-crypto-currencies. Many cryptocurrency proponents believe that such efforts are ultimately good for the wider, decentralized industry because they will allow the public to familiarise themselves with a lighter version of the technology in a setting that they are more comfortable with – i.e. on Facebook.

Lack of ICOs

If you were around the cryptocurrency space in 2017, you’ll know all about the mania that was the initial coin offering or ICO. Basically, a startup would create a digital token on a smart contract platform such as Ethereum and sell the tokens to finance the realization of the dream the firm detailed in its whitepaper when announcing the project itself.

The number of ICOs making tens of millions of dollars for nothing more than an ideal has since shrunk dramatically, thanks largely to regulatory scrutiny from the likes of the US Securities and Exchange Commission. Examples such as the recent legal tussles between the all-important financial regulator and the social messaging application company Kik over the ICO they did selling Kin tokens will no doubt have put many investors and startups alike off the idea.

In place of the ICO, however, is the STO (Security Token Offering) and the IEO (Initial Exchange Offering). Neither of these forms of the fundraiser has garnered anywhere near the same enthusiasm as the 2017 ICO mania. STO sales require investors to be accredited, meaning that most people are excluded. This severely limits their appeal. Meanwhile, IEOs are basically ICOs only sold through an exchange. Since they are just as legally suspect as ICOs and the market is still seeing how most ICO investments ultimately worked out, they have not found massive popularity.

Return of Bitcoin Dominance

Luckily for all Bitcoin holders, it is on the rise once again. Starting at just less than 52 percent as the new year dawned, the figure now stands at almost 64 percent. Several key figures believe this to be crucial for Bitcoin to establish new highs too.

Firstly, Civic CEO and crypto asset proponent Vinny Lingham claim that the market is not yet mature enough to view the different cryptocurrencies by their own merits. He argues that there is no good reason for all digital asset to rise at the same time and until the market “decouples” from Bitcoin, there might well be more trouble ahead for investors.

Similarly, Bitcoin proponent and YouTube trading specialist, Tone Vays believes that Bitcoin must move independently from the altcoins before it will achieve new highs.

However, these two experts stand at odds with many Twitter cryptocurrency analysts who continually call for an “alt-season”.

So far in 2019, there has been a clear trend of Bitcoin decoupling from the rest of the market. We have no idea if it will continue to do so, but it’s certainly something that many people are watching at the moment!

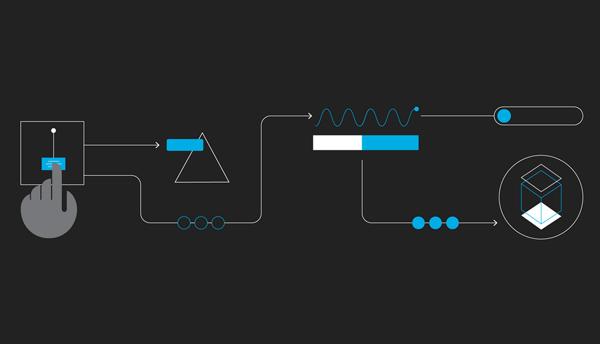

Layers of Bitcoin

Perhaps the most exciting developments to watch in the cryptocurrency world right now are those occurring at the protocol level. Different teams and companies are creating various layers on top of the main chain.

You’ve probably heard about the Lightning Network and those behind it hopes to help relieve congestion on the Bitcoin blockchain at busier times, but what about the Liquid Network or even Microsoft’s ION protocol?

This latter development is particularly interesting given that it shows the Bitcoin blockchain’s immense security put to a non-monetary use case. The project seeks to build an immutable digital identity platform of sorts.

Microsoft is clearly betting on Bitcoin sticking around and we’re sure that other groups of computer scientists will come up with equally impressive applications to be built directly atop the chain. With every application, the chain and its security because ever more valuable so we’re also expecting the price to follow suit!