A few years ago, MasterCard floated the idea of web based ad targeting by using an individual’s credit card purchase history as the source of marketing communication customization. However, the company later chose to shelve the idea citing regulatory issues that dictate how financial service providers are permitted to handle customer information.

Since early 2011, this idea however has significantly evolved where credit card companies provide marketers an analysis of anonymous and aggregated data that is sorted into a variety of marketing segments such as – people with high inclination towards travel, etc.

What the Customers Feel

The general sentiment towards this idea is that not only will these plans, when implemented represent an impressive technological feat, but tying up consumers’ internet lives with their shopping activities would without doubt be considered an erosion of the concept of “anonymity” on the World Wide Web. Customers feel that this move would be nothing less than an effort to profit from selling access to insights that credit card companies acquire about consumers and their credit card transactions.

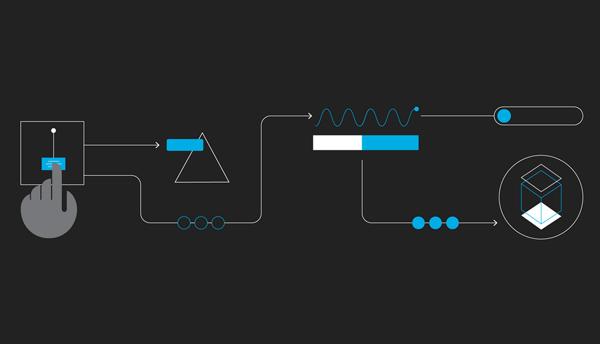

While the technology is still evolving, the potential this process offers are unimaginable. For advertisers, they would be able to show a weight loss ad to an individual who just shopped at a plus size store and also track whether or not that individual bought the products that were marketed. As of now, online ads used by websites such as Facebook and Google are essentially based on an individual’s online history and not by his or her identity or activities in the physical world.

What the Credit Card Companies are Up To

Furthermore, in a rather futuristic move, a Visa patent application includes the incorporation of information from DNA databanks as well as a variety of other personal information that can be leveraged to target people on the web. The company sees significant potential is using a wide variety of personal details to generate profiles that can be used for targeted advertising that goes well beyond one’s shopping history. This move aims to explore the possibility to also use information on social networking platforms, search engines, credit bureaus, insurance claims and DNA banks for what could might as well be labeled as laser targeting.

Visa and MasterCard together – which do not issue credit cards but act as electronic payment processors – are known to possess the world’s largest repository of sales transactions. It has already been a few years since these companies introduced programs with companies such as GAP where retailers were allowed to send text messages to individuals that agree to receive information on real-time discounts on the basis of their transactions.

Considered as a stepping stone to the targeted advertising project, trends in marketing communications are without doubt at the cusp of major shifts globally.