Mobile payments were conventionally seen only as a fancy perk to tech-savvy audiences. It wasn’t something businesses were compelled to offer in order to stay in the game. However, this scenario may be significantly changing.

Apple Pay and what makes it a game changer

With the unveiling of the latest iPhone, Apple also announced the launch of Apple Pay a mobile payment service that is expected to significantly expand the importance and popularity of mobile-based payments. By partnering with over two dozen major retailers such as Whole Foods, McDonald’s and Macy’s along with a variety of popular applications, the company exhibited about users will be able to easily make payments for everything between groceries and their dinner for two through this feature.

How does Apple Pay Work?

iPhone 5 and 6 users can sign up for this service and enter their credit card information or simply take a picture of their card with their phone camera. It is important to point out that Apple already has a significant head-start in this area considering it already has millions of credit card data on file due to its iTunes service.

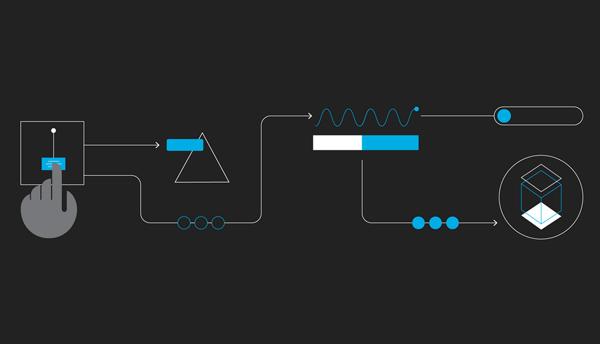

The information on the card is encrypted on a chip known as Secure Element that is embedded into the phone. At participating stores, all the users have to do is hold their phones in from of what is known as a Near Field Communication (NFC) reader and place their finger on top of a fingerprint sensor to confirm the payment.

stores, all the users have to do is hold their phones in from of what is known as a Near Field Communication (NFC) reader and place their finger on top of a fingerprint sensor to confirm the payment.

The application on the phone enables users to select Apple Pay as their method of payment and use the Touch ID to confirm the transaction. This feature will also sync with the new Apple Watch when it hits that market next year. Through this, customers will be able to confirm payments by simply tapping on their watches.

What does this mean for Businesses?

With businesses considering the option of adopting NFC technology, there is now doubt that Apple Pay can soon become a game changer. With a number of large retailers already sold to the idea, taking on this technology has become a question of

competitiveness. With more consumers eventually expected to get used to using their smart phones, tablets and even watches to pay for a variety of things, this sort of convenience will eventually be expected from small businesses as well.

Apple Pay is without doubt a huge step forward in making mobile payment systems more commercially accepted there are still a few analysts that believe it requires some fine tuning. By the time this technology is released this month, it is believed that about 220,000 stores will already be offering Apple Pay. However, this is still a very small slice of the pie that is waiting to be devoured.